Hypersonics Federal Investment

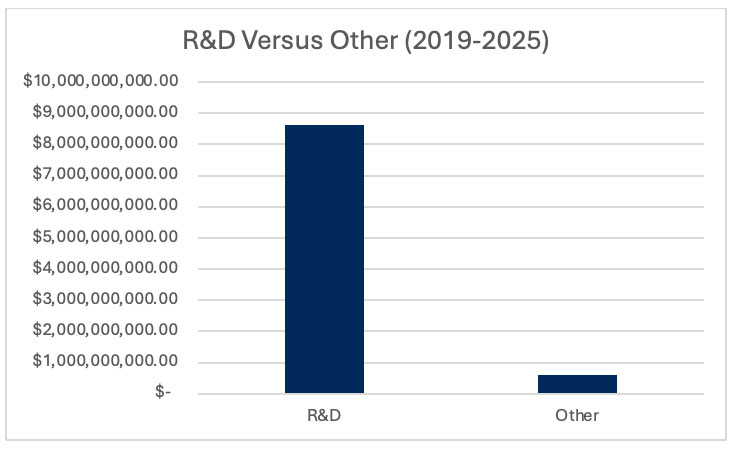

Federal spending on hypersonics has accelerated, but the industrial base remains shaped almost entirely by development rather than production. From 2019 to 2025, more than $9 billion in federal contract obligations flowed into hypersonics programs, with ~93 percent coded to RDT&E, not manufacturing. This reflects a workforce built for innovation, testing, and prototyping rather than steady-rate production.

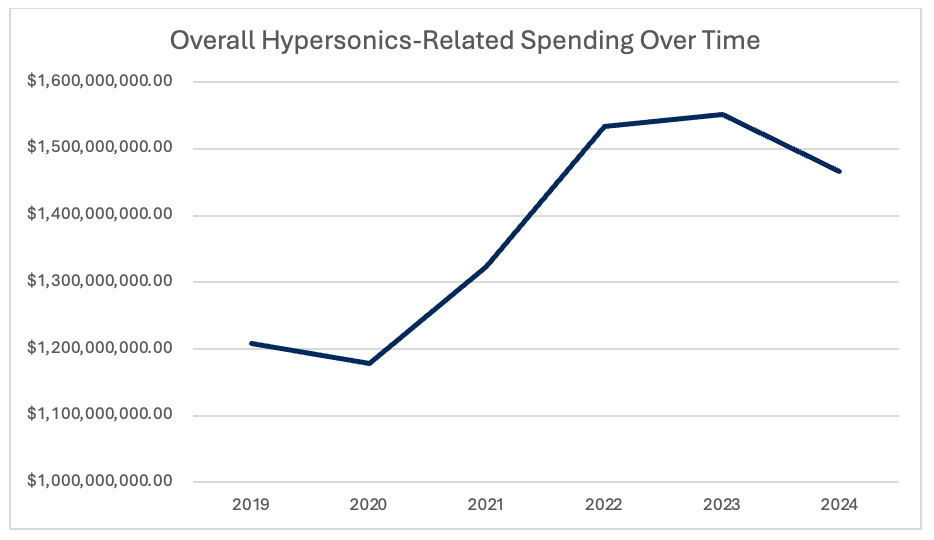

How Hypersonics Spending Has Shifted Over Time

Overall contract spending has grown significantly since 2020, then leveled as programs faced schedule shifts and maturing test campaigns.

A Development-Heavy Industrial Base

Most hypersonics programs remain in extended RDT&E cycles. ARRW’s test setbacks and funding reductions slowed progression toward production, while Raytheon’s HAWC work, feeding into HACM, is still early-stage research. Limited procurement is emerging. The Air Force’s FY26 ARRW request and the Navy’s initial CPS buys (six missiles in FY26, rising to 22 in FY27) signal movement toward low-rate initial production, but the buys remain episodic.

A simple breakdown highlights how heavily the portfolio leans toward research.

Despite Lockheed’s contract dominance, Raytheon shows more hiring activity, reflecting the field’s continued emphasis on engineering, modeling, and test operations. Full-rate production will require major expansions in manufacturing capacity and test infrastructure later this decade.

Jobs Supported Today

Current hypersonics spending supports:

- 4,500+ direct jobs

- 4,000+ indirect supply-chain jobs

These roles are concentrated in engineering, systems development, test operations, and prototype manufacturing. Production jobs remain limited due to the maturity of current programs.

Where Industry Is Investing

Contract activity reflects R&D priorities:

- Lockheed Martin: $3.8B for CPS development

- Northrop Grumman: $9.9M prototype sensor systems

- Carbon Carbon Advanced Technologies: $2.8M prototype glide target

- Ultramet: $1.9M in ceramic matrix composite scaling

- Rockwell Collins Australia: $17.6M in flight-test hardware

These efforts cluster around materials, sensors, thermal protection systems, and test hardware rather than production tooling or assembly lines.

What Employers Need Most

Current demand is overwhelmingly engineering-focused:

- Aerospace, mechanical, electrical, and systems engineers

- Skills in MATLAB/Simulink, CFD, DAQ, GD&T

Supply-chain roles are rising, with 703 postings from Jan 2023 to Dec 2024, indicating preparation for future scaling.

Technician demand remains modest but includes CMM measurement, machining, inspection, NDT, composite handling, and ablative material work.

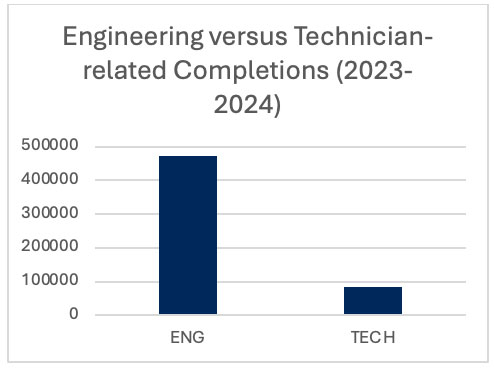

Education Pipelines: Strong Engineering Output, Limited Technician Supply

Engineering completions align well with today’s R&D-driven posture. Technician program output is far lower, especially in machining, industrial technology, and quality control.

This imbalance is clear in recent completion data.

Welding programs produce more graduates, but hypersonics requires AWS D17.1 certification and experience with high-temperature alloys and controlled environments.

Readiness Gap for Future Production

If programs transition into production later this decade, demand will rise sharply for:

- Precision machinists

- Composite technicians

- NDT specialists

- Advanced welders for exotic alloys

- Test and instrumentation technicians

Pathways already forming include:

- Engineers moving into modeling, instrumentation, and test ops

- Welders upskilling into specialty alloy welding

- Community college graduates entering CNC machining, composite lay-up, and NDT roles

Key Takeaway

The U.S. hypersonics workforce is built for innovation, not production. Engineering pipelines are strong, but machining, composites, welding, and NDT talent remain insufficient for sustained manufacturing. Closing this readiness gap will determine how quickly prototype systems can transition into full-rate production.